QATAR CORPORATE TAX FILING 2020 TAX ALERT

In September 2020, the General Tax Authority (The GTA) introduced the new online tax portal “Dhareeba” which enables all registered taxpayers to submit their annual corporate income tax returns as well as various other declarations and reports electronically.

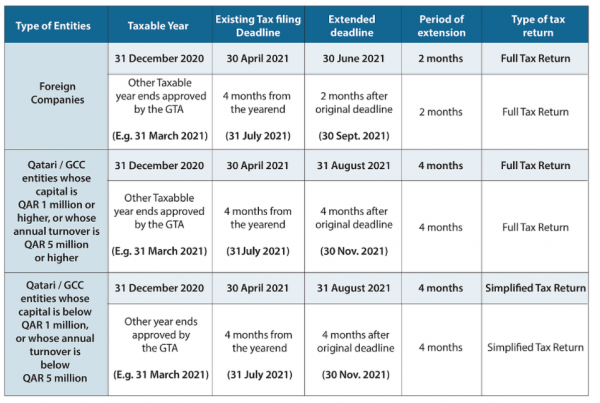

Tax Filing Deadline

First of all, we would like to draw your attention that no general extension has been granted by the GTA as of today. Therefore, the tax filing deadline for the companies with 31 December 2020 as yearend will be 30 April 2021.

Specific Request for an Extension

We would like to draw your attention to Article 30 of the executive regulations of the Income Tax Law No 24 of 2018, which states that the GTA may grant an extension for the deadline to file tax returns for a period of up to four months. Extension applications for the returns that have a submission deadline on April 30, 2021 must be submitted to the GTA before February 28, 2021.

Taxpayers should be noted here that to obtain an extension of the period for submitting tax returns the taxpayer must provide proper backups to the GTA that proves the reasons that made him unable to file income tax return by the deadline set on April 30, 2021. And the mentioned request should be submitted 60 days prior to the original tax return submission deadline. Based on the above, we recommend submitting extension requests with proof of support for the application as soon as possible.

We will be pleased to assist your business with requests to extend the deadline and ensure that the requests are submitted in the right way and in a timely manner.

OFFICE SAAD AHMED AL KUWARI FOR ACCOUNTING AND AUDITS APPOINTMENT AS TAX REPRESENTATIVE ON DHAREEBA PORTAL

We also ask relevant taxpayers to ensure that OFFICE SAAD AHMED AL KUWARI FOR ACCOUNTING AND AUDITS is appointed as their tax representative on the Dhareeba tax portal so that we can ensure that there is no technical error that may be the reason for not submitting tax returns on time. This will also assist us in timely submitting of the tax return on Dhareeba portal in this regard; please find attached the manual explaining the steps which need to be taken to complete the appointment.

How can OFFICE SAAD AHMED AL KUWARI FOR ACCOUNTING AND AUDITS help you?

In this respect, OFFICE SAAD AHMED AL KUWARI FOR ACCOUNTING AND AUDITS can help to be ready to comply with requirements of corporate income tax compliance by reviewing Dhareeba profile of your business and supporting in the following

- Communication with GTA

- Submission for an extension application

- Providing required documentation requested by the GTA

- Checking Dhareeba profile of your business for assurance purposes

- Support in submission of corporate income tax return